Summary

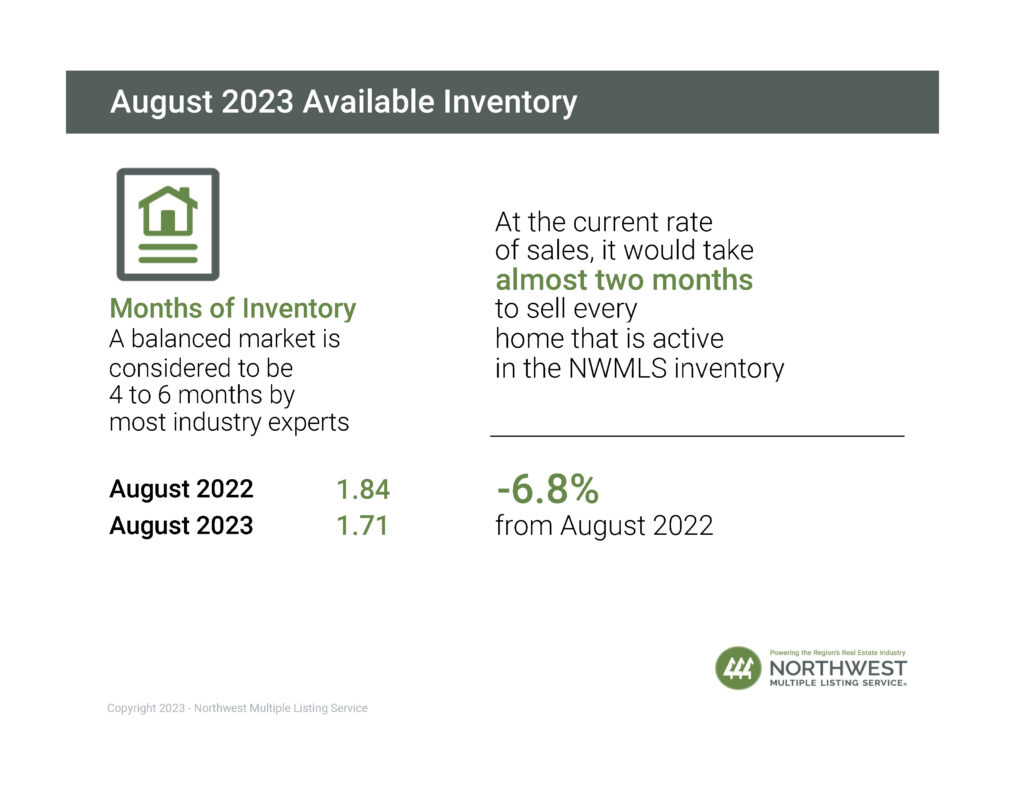

Inventory levels remain low as buyers continue to compete for available housing.

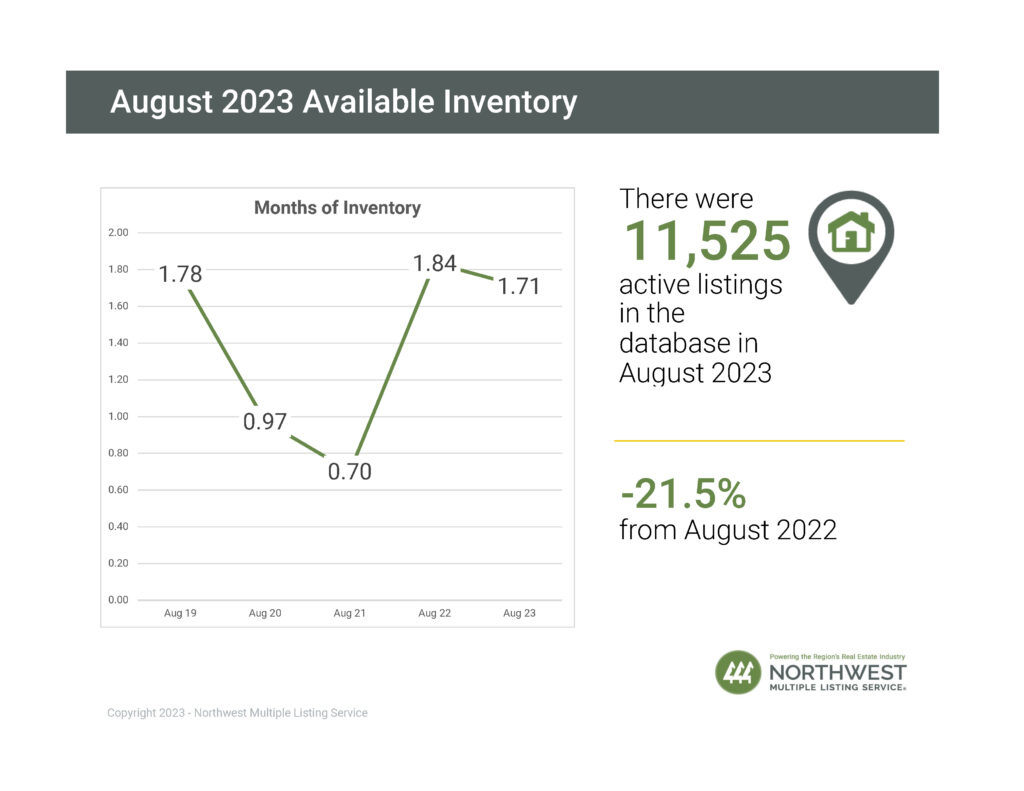

- Inventory Remains Low: Despite slower activity, supply remained constrained with only 1.71 months of inventory in the Puget Sound Region. That’s down from both a year ago when there was 1.84 months of supply, and from last month when the figure was 1.76. King, Pierce, and Snohomish Counties all have inventory levels lower than the overall region.

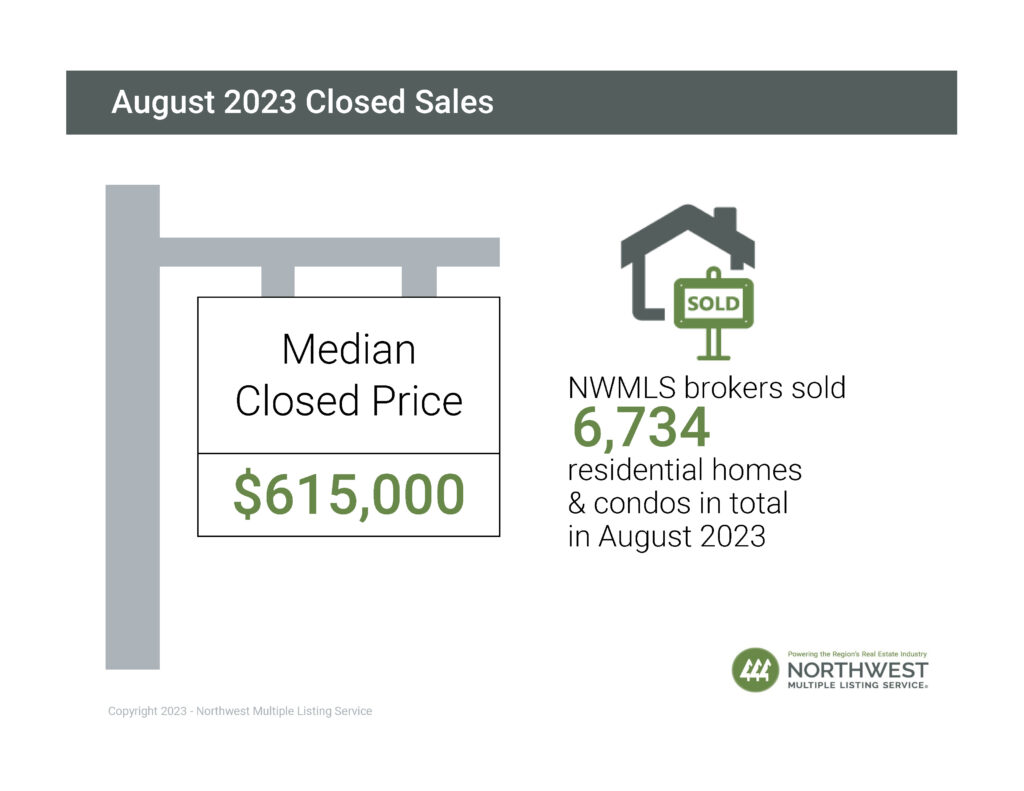

- Home Prices are Holding Steady (Slightly Up): Prices on homes that sold during August rose 2.5% from a year ago, marking the first year-over-year (YOY) increase since January. NWMLS data show month-over-month prices rose in 17 of the 26 counties in its service area.

- High Interest Rates Continue to Impact Sales: The average interest rate on a 30-year home loan reached 7.23% as of August 24, according to Freddie Mac. That is the highest rate since 2001. Escalating rates are a deterrent to would-be sellers who bought or refinanced a home in recent years and don’t want to swap their 3% rate for a 7% mortgage.

- What’s Next Year Looking Like?: Just a prediction, but expect prices to rise slightly as interest rates are projected to come down a bit and competition likely increases; think of more buyers for the same number of homes.

Details

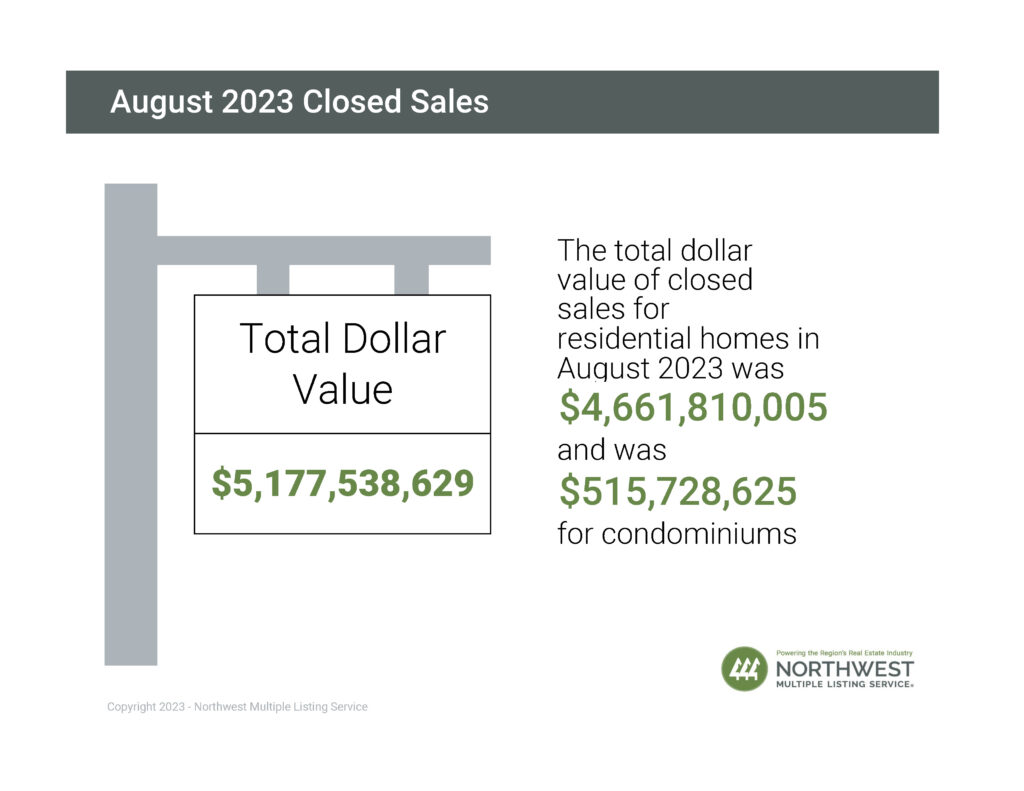

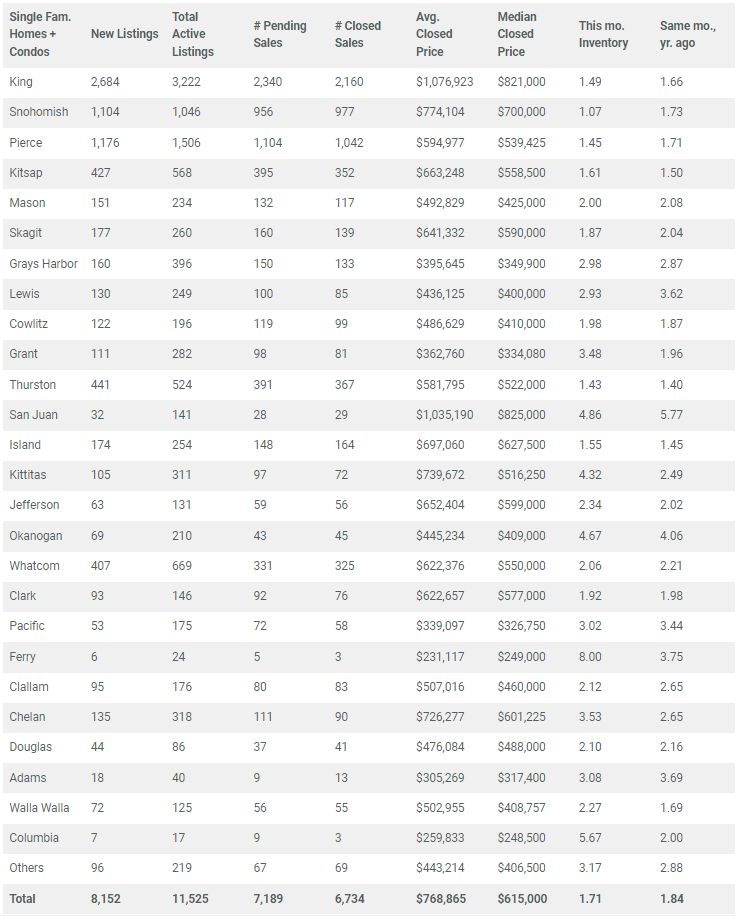

Prices on homes that sold during August rose 2.5% from a year ago, marking the first year-over-year (YOY) increase since January, according to a new report from Northwest Multiple Listing Service. The median price of $615,000 for 6,734 closed sales across 26 counties matched July’s figure.

For other key metrics on August activity, including new and active listings, pending sales, and closed sales, the YOY comparisons showed declines.

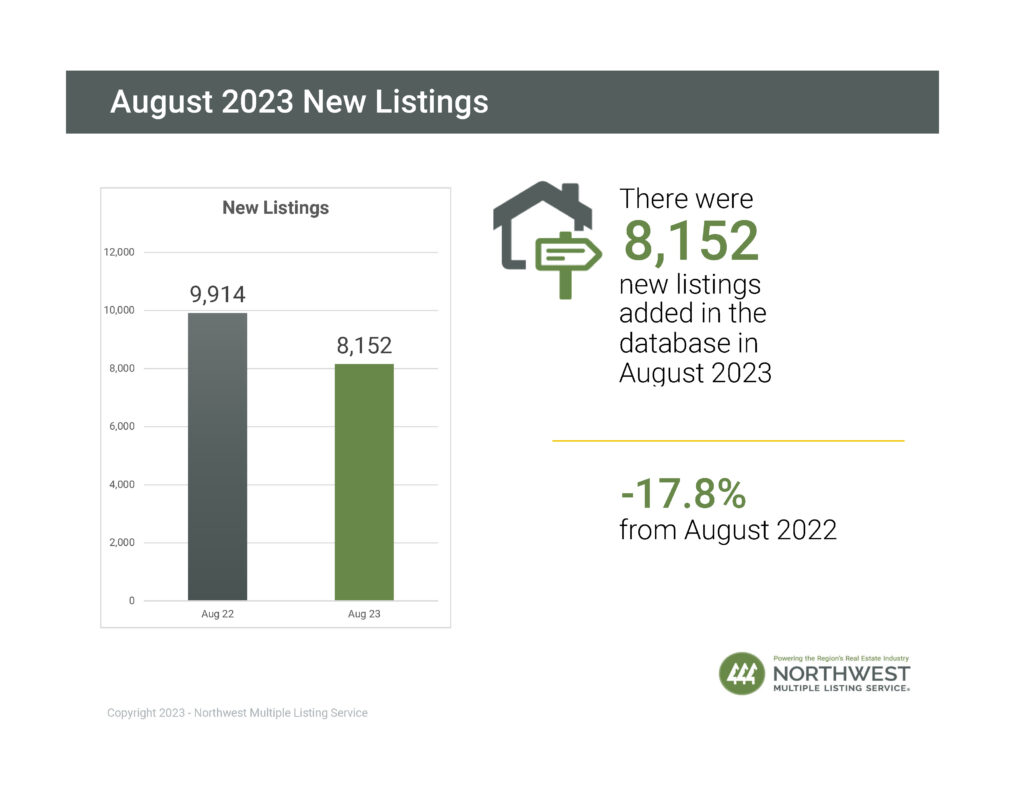

Brokers added 8,152 new listings of single-family homes and condominiums last month, down from 9,914 for August 2022, a drop of nearly 17.8%. Last month’s systemwide tally of new listings was the smallest monthly total since April.

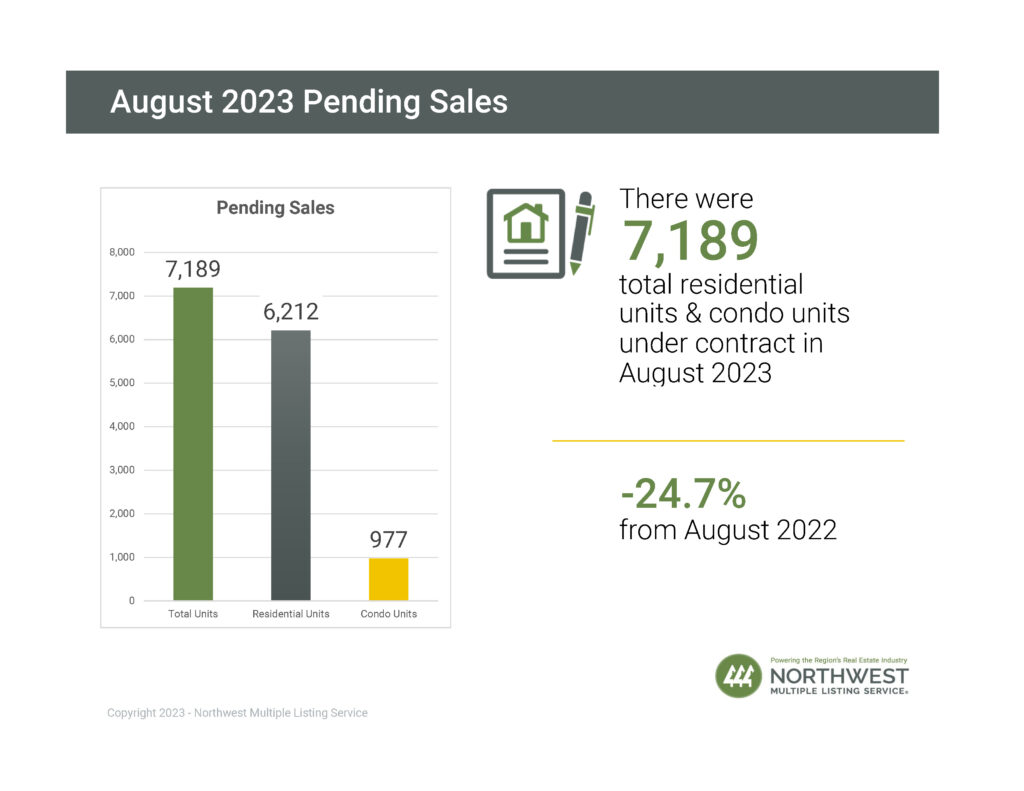

NWMLS members reported 7,189 pending sales during August, which was the lowest level since April’s total of 7,137, and down nearly 25% from the year ago figure of 9,552.

Brokers and other industry-watchers point to upticks in mortgage rates as the culprit for declining sales.

The average interest rate on a 30-year home loan reached 7.23% as of August 24, according to Freddie Mac. That is the highest rate since 2001, but it subsequently dropped to 7.12% for the week ending September 7. Along with forcing buyers to sit on the sidelines, the escalating rates are a deterrent to would-be sellers who bought or refinanced a home in recent years and don’t want to swap their 3% rate for a 7% mortgage.

Despite slower activity, supply remained constrained with only 1.71 months of inventory in the MLS database. That’s down from both a year ago when there was 1.84 months of supply, and from last month when the figure was 1.76.

NWMLS data show month-over-month prices rose in 17 of the 26 counties in its service area, with one other county unchanged.

New listings, if properly priced, are attracting multiple offers, often selling for more than the asking price.

A check of Northwest MLS data shows the sale price to list price ratio averaged 100% or higher for last month’s completed transactions in seven counties: Douglas, King, Kitsap, Mason, Pierce, Snohomish, and Thurston.

Active buyers need to put forth their best offer on their desired home. They should be prepared to offer full price or better and they should expect multiple offer situations for correctly priced new listings.

The median price in Kitsap County, at $558,500, is up more than 2% from a year ago. “People are on the move and they continue to purchase despite the rate hikes.” Leach said part of the demand comes from counties to the east where homes are more expensive.

Compared to King County, where the median price for last month’s sales was $821,000, a home in Kitsap County costs $262,500 less.

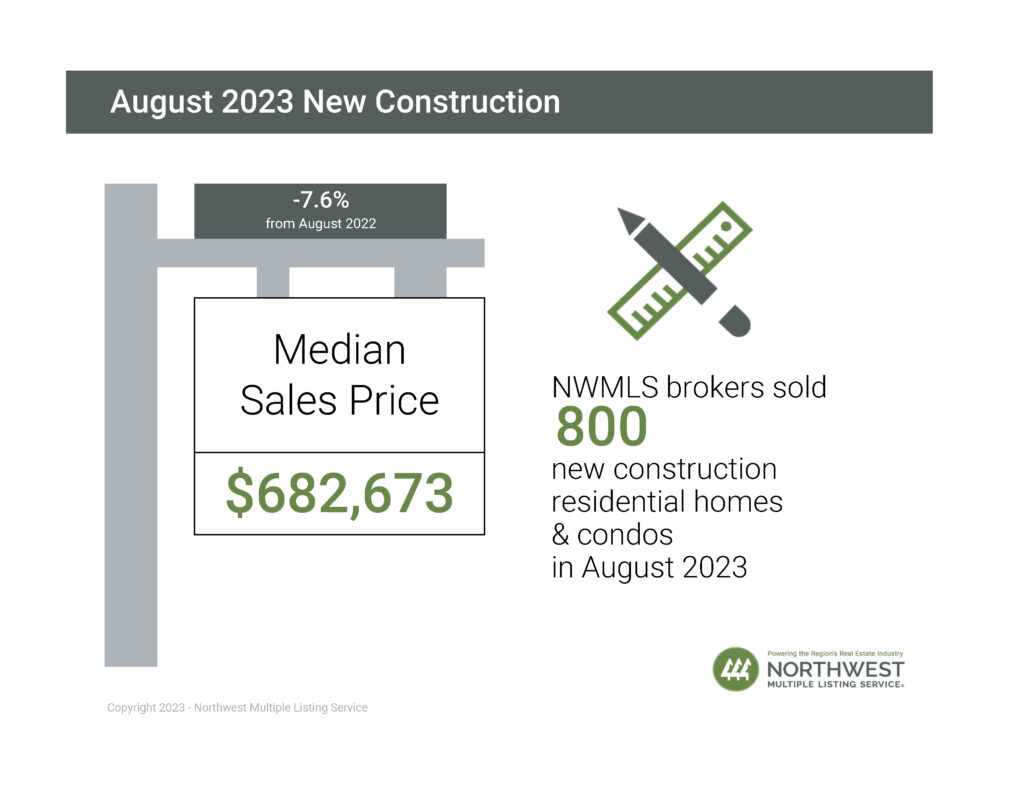

Some hopeful homebuyers are turning to new construction where some builders are offering discounts or other incentives. About 25% of builders have been cutting prices to bolster sales, according to a survey by the National Association of Home Builders (NAHB). Some builders are also designing somewhat smaller houses “in an effort to keep prices in check.”

Northwest MLS figures for August show brokers sold 800 newly built homes at a median price of $682,673. That’s down about 7.6% from a year ago when the sales price was $738,950.

Buyers may also find options in the condo segment. Although the selection is limited, with 1.76 months of supply, prices are considerably less than a single-family home. For last month’s sales, the median price was $465,000, up 3.3% from a year ago.

The real estate market continues to transition… limited inventory and rising interest rates continue to keep inventory levels low and prices relatively stable. If you are waiting for interest rates or prices to drop significantly, it is not likely to happen in the near future. The housing market will continue to be challenging over the coming months or even years.

Whether buying, selling, or investing in real estate, be sure to utilize the expertise, talent, and professionalism of our trusted real estate team. Let us know how we can help you achieve your real estate Wants, Needs, and Dreams.

Data

*Information and statistics compiled and reported by the Northwest Multiple Listing Service.