Summary

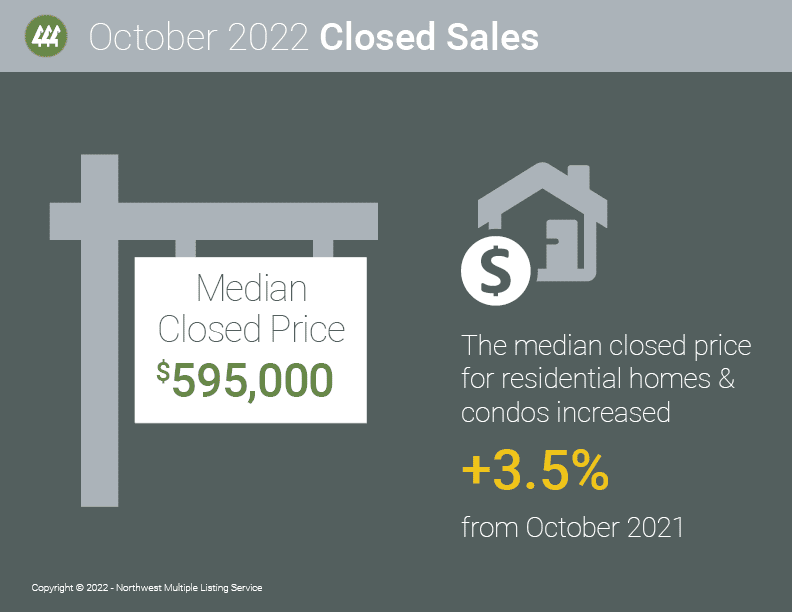

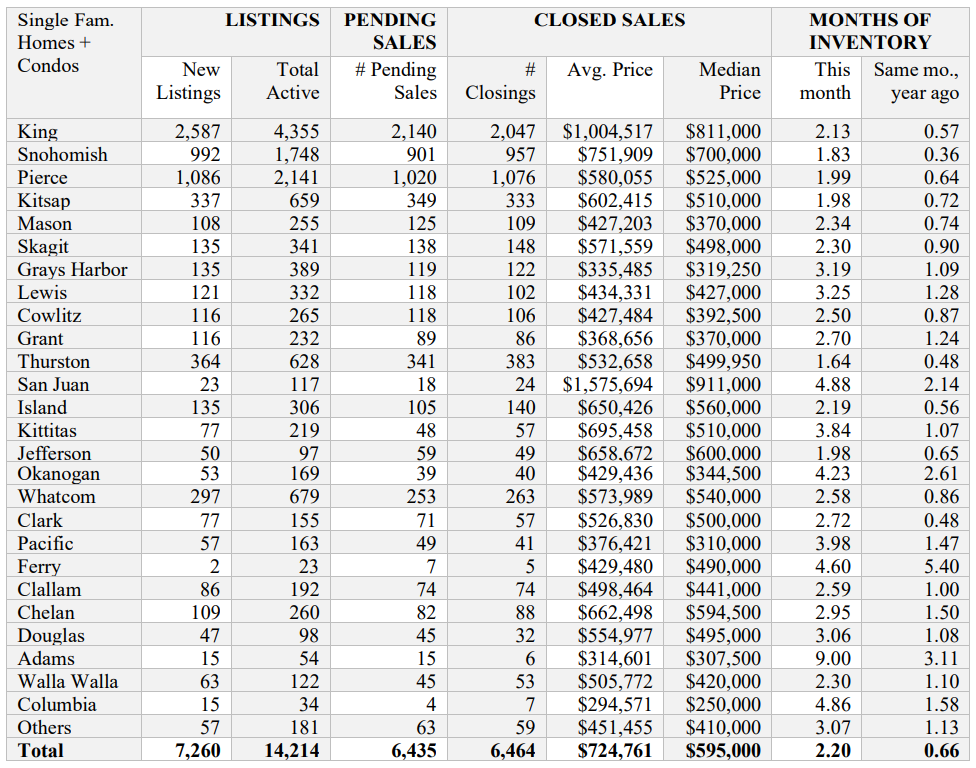

- The Housing Slowdown Is Real: In addition to seasonal slowdowns in the winter months in the Pacific Northwest, high prices and increasing interest rates are really contributing to the slowdown. The median price on last month’s completed sales of single-family homes and condominiums was $595,000. That was an increase of about 3.5% from twelve months ago across the Puget Sound Region. Pending sales dropped about 39% and closings declined around 35% from this same time last year.

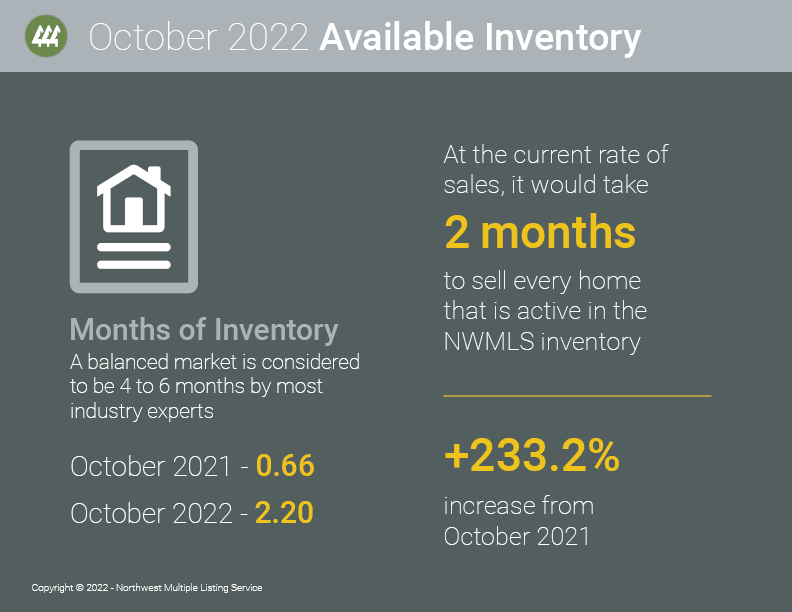

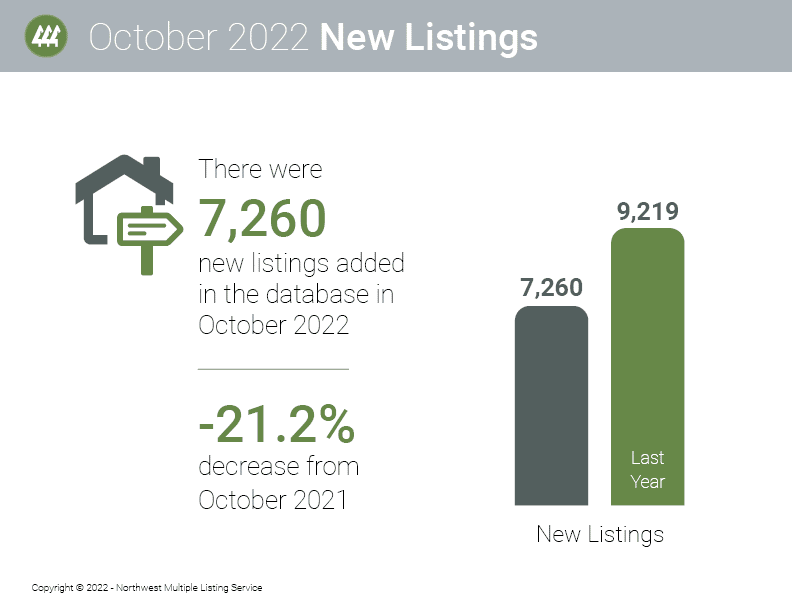

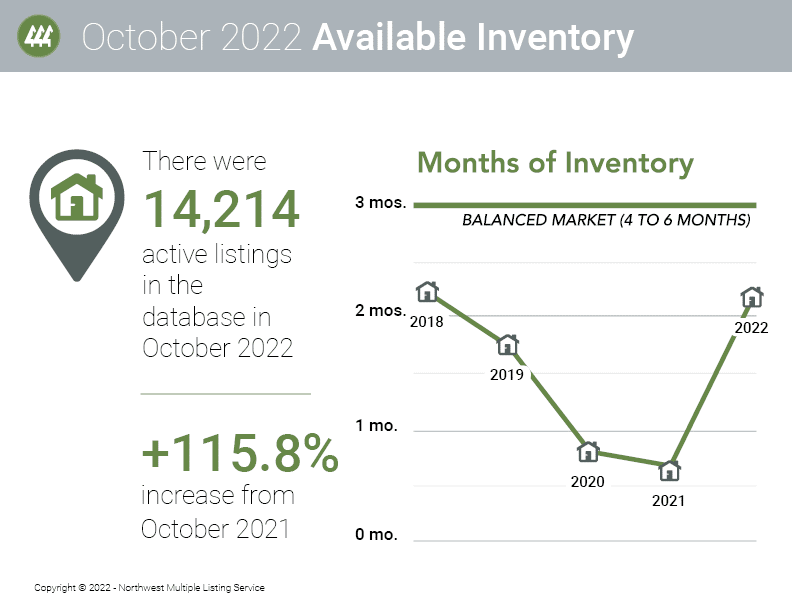

- Buyers, It’s Time To Shop: With the additional inventory, buyers looking to purchase homes right now have additional time to shop, enjoy greater selection, and have the ability for real negotiations throughout the entire purchase process. Don’t wait for the “cheap” home to appear… you will most likely miss the opportunity of greater selection that exists right now. During October, Brokers added 7,260 new listings, down about 21% from the same month a year ago. At month end, the selection included 14,214 active listings which was more than double the year-ago inventory of 6,588.

- What Your Neighbor’s House Sold For 6 Months Ago Isn’t Relevant: Keep in mind the market has changed. Prices will most likely continue to settle and actually go down throughout the coming year. Price your home correctly for the market we are now in.

- Hire Only Trusted And Experienced Real Estate Brokers And Lenders: Both buyers and sellers need strong and creative negotiators on their side (again). In addition, buyers need to get creative with their financing (back-to-basics financing actually) and consider options like buydowns, adjustable-rate loans, carrying back second deeds of trust, and seller paid closing costs.

Details

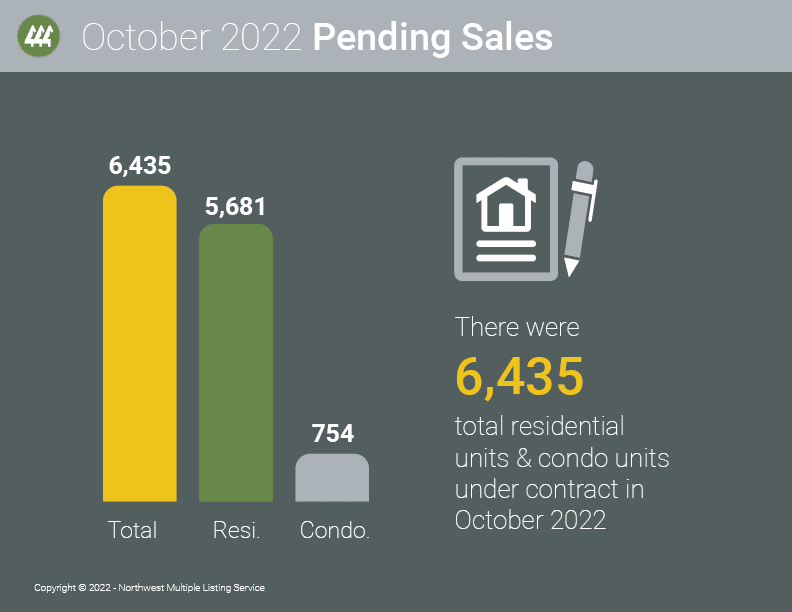

Brokers with Northwest Multiple Listing Service (NWMLS) are reporting a return to some creative financing methods as motivated home buyers and sellers grapple with higher mortgage rates. Despite that, and the seasonal slowdown in activity, 6,435 hopeful homebuyers succeeded in having sellers accept their offers to purchase during October.

“Buyers are benefiting from more choices in inventory and less competition, while sellers are more negotiable when it comes to contingencies,” reported NWMLS director Meredith Hansen. “We are seeing more 2/1 buydowns and adjustable-rate mortgages with buyers planning to refi when the rates come back down,” added Hansen, the founder and operating principal at Keller Williams Greater Seattle.

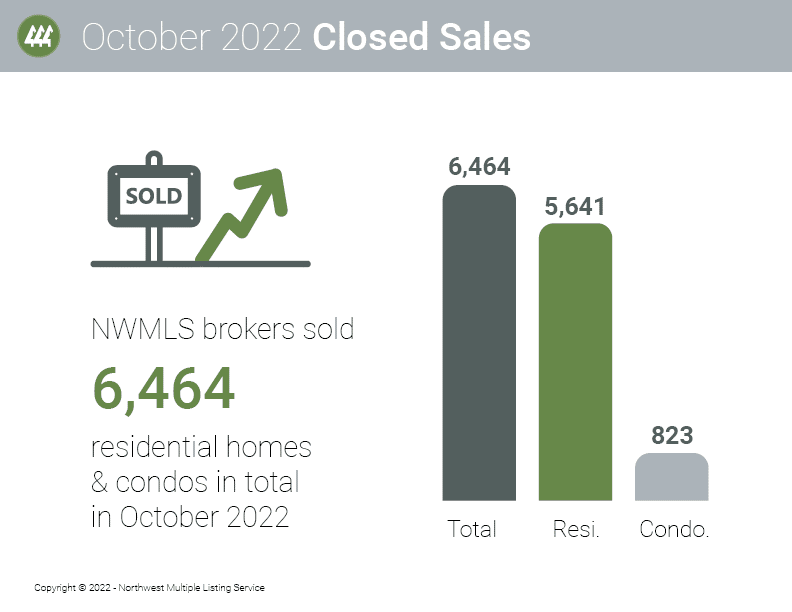

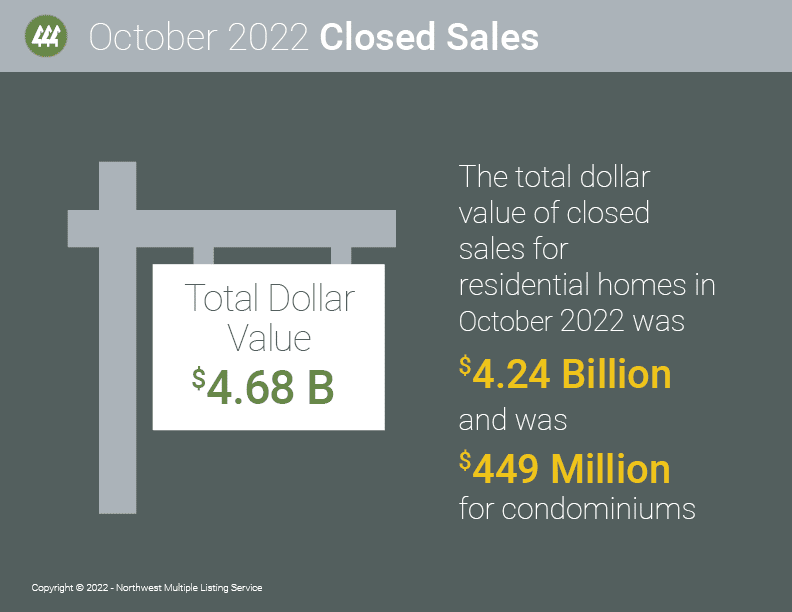

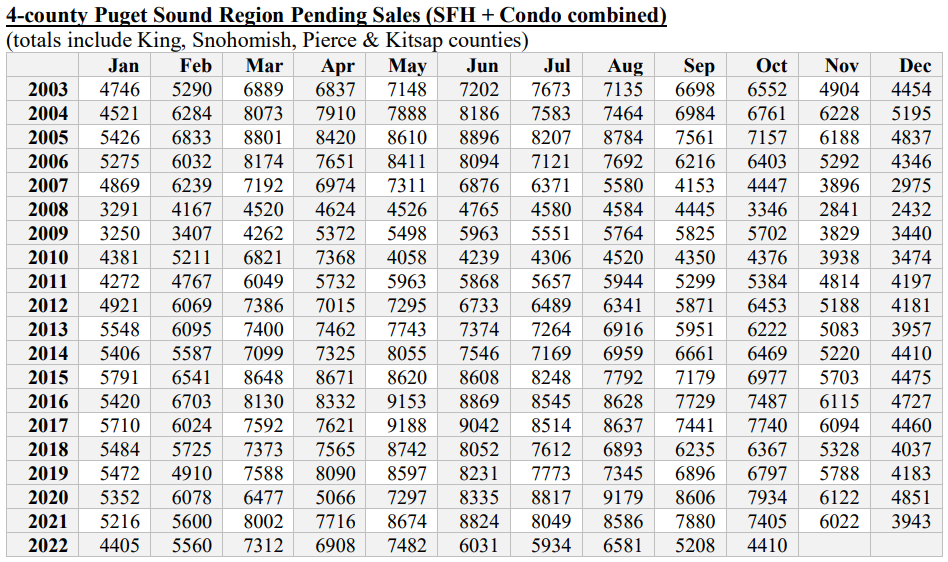

The latest Northwest MLS shows 6,435 pending sales last month, and about the same volume (6,464) of closed sales. Both figures were down from the year-ago totals, with pending sales dropping about 39% and closings declining around 35%.

Median sales prices still rose year-over-year in most of the 26 counties on the report. Area-wide, the median price on last month’s completed sales of single-family homes and condominiums was $595,000. That was an increase of about 3.5% from twelve months ago, but a decline of approximately 9% from May when prices peaked at $660,000.

Homes and condos in San Juan County commanded the highest prices, with a median sales price of $911,000 – and that was a 7.5% decline from a year ago. Last month’s closings in King County had a median price of $811,000, up more than 8% from the year-ago figure of $750,000.

A comparison of counties shows price drops in nine of them. Seven counties had double-digit gains, but improved inventory and interest rates were the storyline for many of the brokers who commented on the NWMLS statistics.

Brokers added 7,260 new listings during October, down about 21% from the same month a year ago. At month end, the selection included 14,214 active listings of single-family homes and condos system wide. That was more than double the year-ago inventory of 6,588.

The uptick in supply boosted the months of inventory figure to 2.2. That is the highest level, based on this metric, since January 2019.

Also commenting on interest rates was the National Association of REALTORS®, which noted the slight dip in mortgage rates this week despite the Federal Reserve approving another 0.75% rate hike for the fourth time this year. NAR cited Freddie Mac’s 30-year fixed mortgage rate that fell to 6.95%, down from 7.08% the previous week. “It seems that rates have already priced in some of the effects of the Fed’s higher interest rates. It is also promising that this was likely the last rate hike of this magnitude, as indicated by the Fed,” wrote Nadia Evangelou, NAR’s senior economist and director of forecasting.

Evangelou also speculated “a return to the sky-high interest rates of the 1980s isn’t likely in today’s economy” and drew comparisons to payments now with those of 40 years ago in today’s money. “In real terms, after adjusting the median home price for inflation, the monthly mortgage payment was about $450 higher in 1982 than it is now,” she wrote in a blog, adding, “If mortgage rates were currently 9% the monthly mortgage payment would be comparable to 1982 rates. Thus, in real values, current buyers pay less for their home purchase than buyers who purchased their home 40 years ago, although home prices are significantly higher now.”

To better navigate the ever changing real estate market conditions, it’s even more important for you to work with a professional real estate advisor. Whether buying, selling, or investing in real estate, be sure to utilize the talent and expertise of our trusted real estate team, The Goelzer Home Team.

Let us know how we can help you achieve your real estate Wants, Needs, and Dreams!

Data

*Information and statistics compiled and reported by the Northwest Multiple Listing Service.