Summary

- Rising Interest Rates Aren’t All Bad: The rising interest rates have actually helped cool off the increasing home prices we’ve been experiencing the past few years. While home prices may not be dropping, we should start seeing prices start to level off in most areas over the next few months.

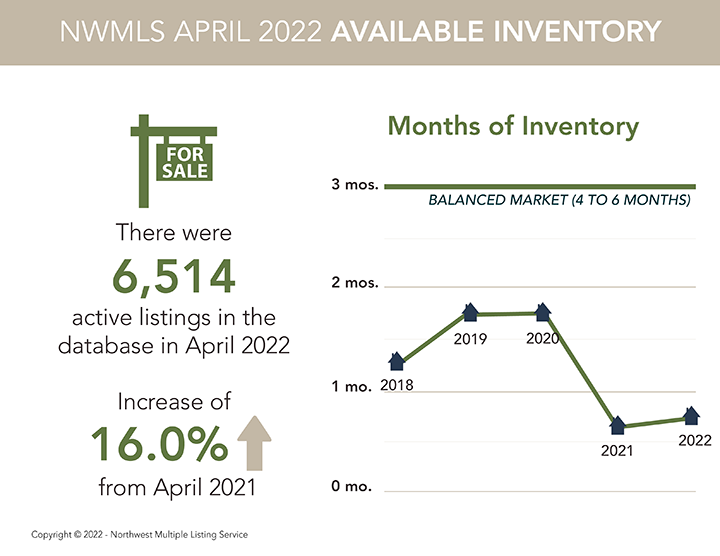

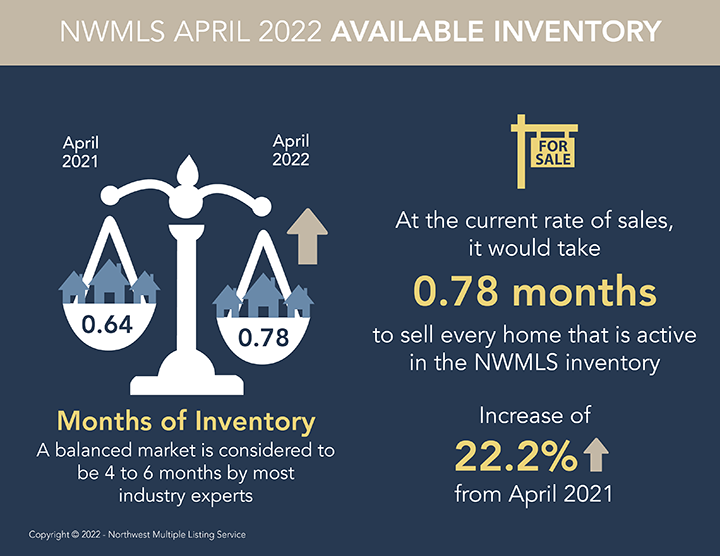

- Some Good News For Buyers: Inventory is growing, with a couple exceptions; King and Jefferson Counties. Overall, at the end of April, there were approximately three weeks (0.78 months) of inventory of single-family homes and condos combined. By this metric, that is the highest level of inventory in nearly 18 months. Good news!

- So Your Neighbor Told You The Housing Market is About to Crash?: While this makes for a great headline, it’s not quite reality. Unlike the previous housing bubble, most homeowners now have significant equity in their homes, purchased with loans supported by higher government and lender standards as well as having independent home appraisal conducted. What we are more likely to see is a balanced market moving forward; a market where buyers have more choices, and sellers will need to price their homes more carefully and be prepared for negotiations throughout the entire purchase and sale process.

Details

Rising interest rates and inflation, coupled with slight improvement in inventory, may bring some normalcy to Western Washington’s frenzied housing market, suggests some brokers with Northwest Multiple Listing Service.

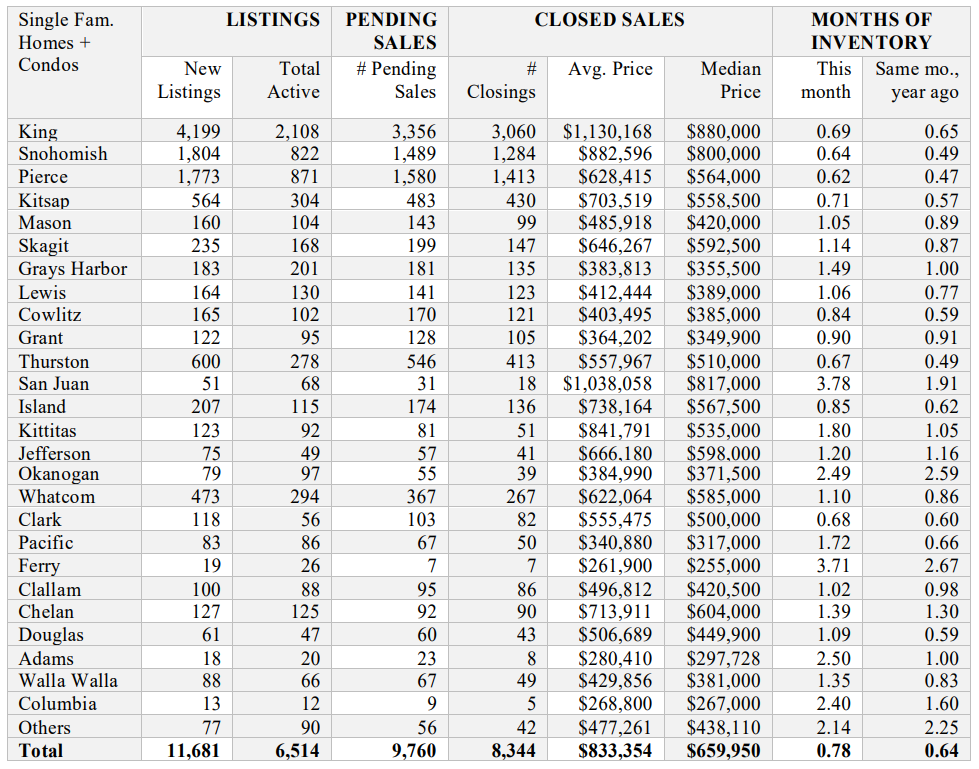

Last month’s sales of single-family homes and condominiums across 26 counties in the report had a list price to sales price ratio of 107.8%, which was down from March when it reached a 12-month peak of 108.2%. A year ago, the ratio was 106.6%.

The latest MLS report showed a mix of positive and negative numbers.

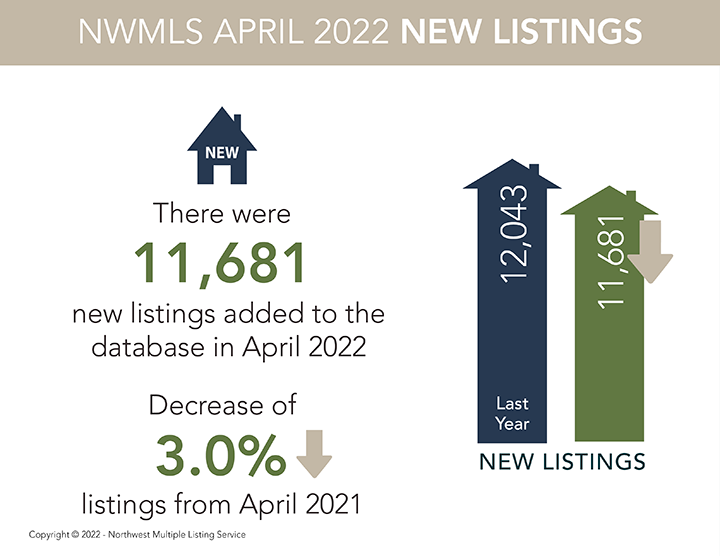

Member-brokers added 11,681 new listings of single-family homes and condos during April, the highest number since last July when 12,916 listings were added.

Only two counties, King and Jefferson, had year-over-year drops in inventory.

At month end, the selection of single-family homes and condos in the database totaled 6,514, the highest level since September 2021 when there were 7,757 total active listings.

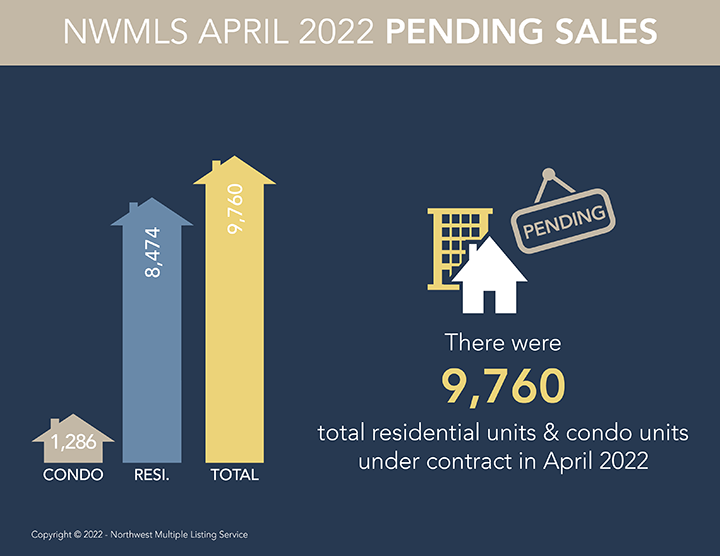

Notably, the number of new listings (11,681) surpassed the number of pending sales (9,760), to help boost inventory. Pending sales were down about 7.8% from a year ago and down 3% from March.

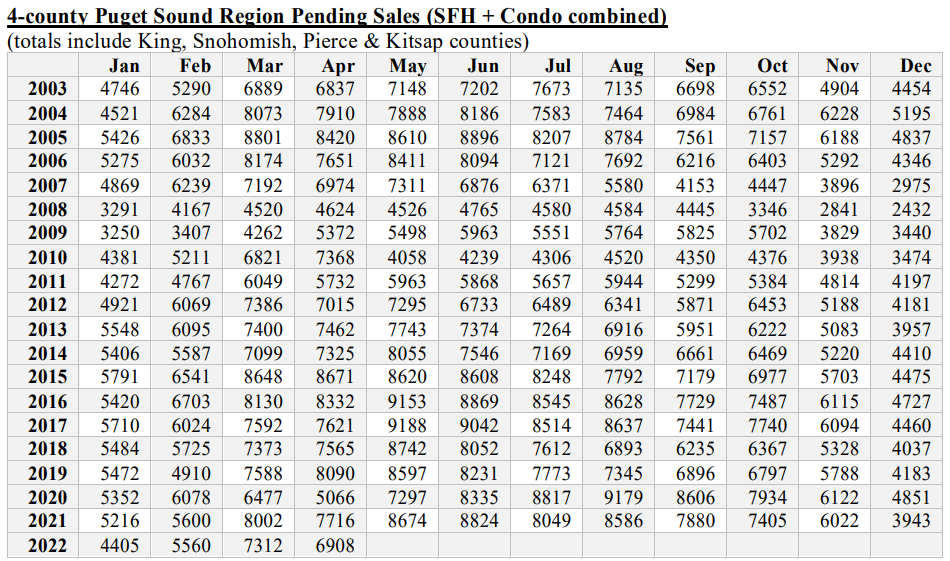

Commenting on April’s improvement in total inventory compared to a year ago, James Young, director of the Washington Center for Real Estate Research at the University of Washington, suggested “This is evidence that interest rates are having a cooling effect on some parts of the suburban market and along the I-5 corridor.”

Young also noted a sharp decline in condo inventory in King County from a year ago, down about 35% countywide, with even greater shrinkage in Southwest King County (-49%) and the Eastside (-42%). With limited selection, sales in those areas also plunged, while prices increased. For condos system-wide, the median price on last month’s sales was $485,000 (up 15.5% from a year ago); in King County, where more than 60% of sales occurred, YOY prices rose 12.6%, from $460,000 to $518,000.

Area-wide prices for single-family home sales (excluding condos) in King County also increased, climbing nearly 20% from a year ago, from $830,000 to $995,000.

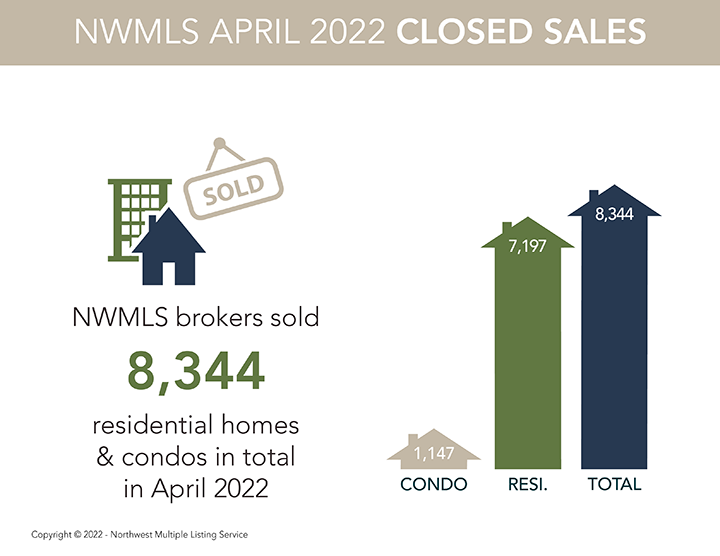

Closed sales of homes and condos slid from a year ago, from 8,791 to 8,344 for a drop of around 5.1%.

The NWMLS report shows there was about three weeks (.78 months) of inventory of single-family homes and condos combined at the end of April. By this metric, that is the highest level in nearly 18 months. MLS data show there was .80 months of supply in October 2020.

Despite the improving inventory, and in spite of rising interest rates, brokers report brisk activity and are not seeing prices ease much.

Brokers in Kitsap County report robust activity in all areas.

The MLS report shows listings of single-family homes and condos in Kitsap County are up nearly 36% from a year ago. Pending sales improved 6.9% YOY, with closed sales climbing 9.4%. The median price has increased more than 15% from twelve months ago, from $485,000 to $558,500.

NWMLS figures show the median price of sales during April in Lewis County was $389,000; in Mason County it was $420,000; and in Thurston County it was $510,000.

With mortgage interest rates drifting upward in anticipation of the Federal Reserve’s hikes in its baseline interest rate, some brokers recommend quick action by prospective home buyers.

Lawrence Yun, chief economist at the National Association of REALTORS, noted affordability “greatly worsened” in the first quarter of 2022, pointing to sustained price appreciation and higher mortgage rates. NAR reported the monthly mortgage payment on a typical existing single-family home with a 20% down payment rose $319, or 30%, from one year ago, to $1,383.

Yun said price declines are “unlikely,” but he expects “more pullback in housing demand as mortgage rates take a heavier toll on affordability. Declining affordability is always the most problematic to first-time buyers who have no home to leverage, and it remains challenging for moderate-income potential buyers as well.”

During these changing and challenging market conditions, it’s even more important for you to work with a professional real estate advisor. Whether buying, selling, or investing in real estate, be sure to utilize the talent and expertise of our trusted real estate team, The Goelzer Home Team. Let us know how we can help you achieve your real estate Wants, Needs, and Dreams!

Data

*Information and statistics compiled and reported by the Northwest Multiple Listing Service.