Summary

- Still A Seller’s Market: While most every home listed for sale is selling at or above list price, it’s those homes that are clean, defect free, staged, and move-in-ready that continue to receive multiple escalating offers. Buyers… be pre-approved or underwritten and be ready to present your BEST offer.

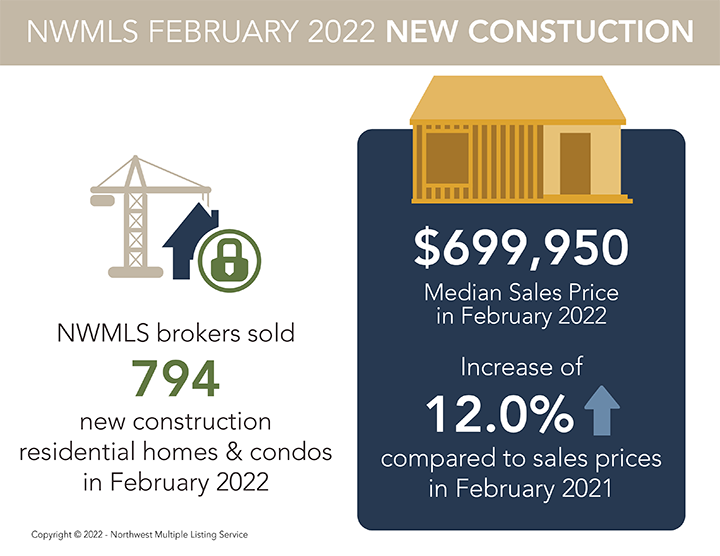

- Price Appreciation Continues to Slow Slightly: Prices for single-family homes rose at a smaller rate, about 12.2%, increasing from of $535,000 a year ago to a median of $600,000 last month. Condo prices soared nearly 23% area-wide, with a YOY jump from $399,000 to $490,250.

- I’ll Repeat This One… Be Your Own Landlord: Despite the lack of inventory and rising interest rates, buying is often a better option than renting. While interest rates are rising, so are rental rates. If you dream of home ownership, there are options out there for you… choose to be your own landlord.

- More Homes Are On The Way: It’s spring time and sellers are preparing their homes for sale. So, Buyers… be prepared!

Details

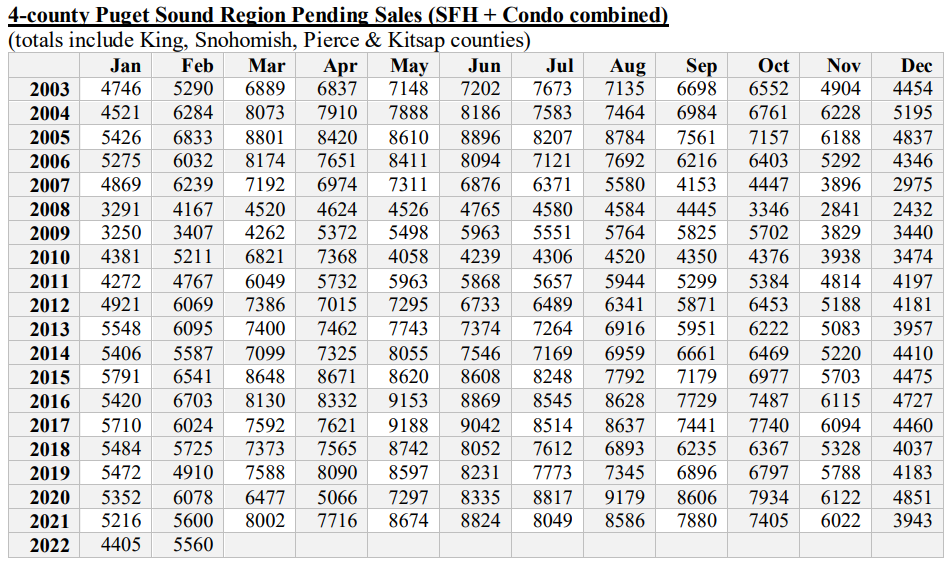

Multiple offer situations are the norm for today’s home buyers, but some brokers with Northwest Multiple Listing Service suggest February’s improving inventory and a slowing pace of price increases may ease some of the competitive pressures.

Commenting on the latest statistical report from Northwest MLS, representatives of the service expressed optimism for the housing market as pandemic-related restrictions ease, but also uncertainty due to the global economic crisis around Russia’s invasion of Ukraine.

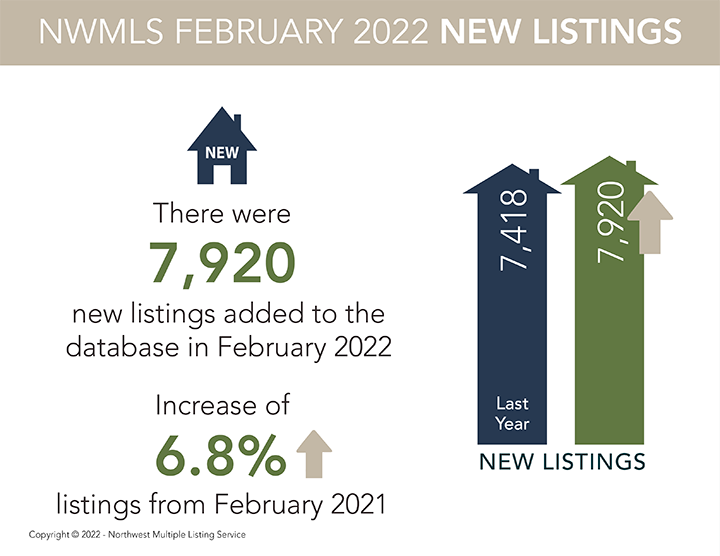

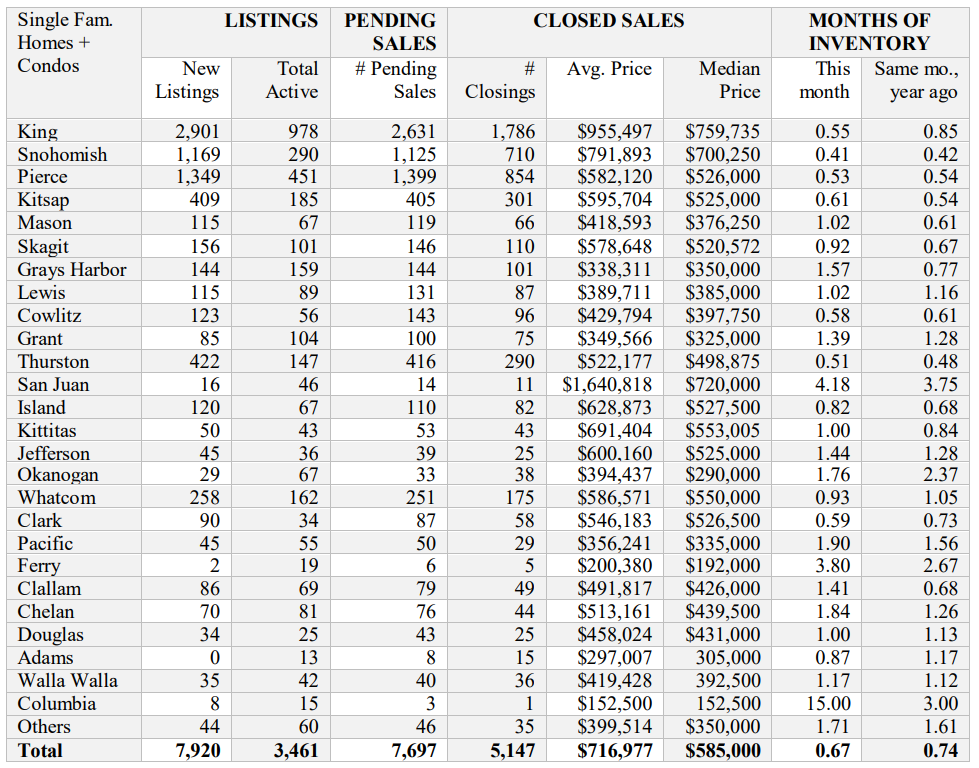

Northwest MLS brokers added 7,920 new listings to inventory during February, a 6.8% improvement from a year ago, and a gain of more than 33% from January’s total of 5,927. Pent-up demand led to big month-over-month gains in pending sales and more shrinkage in overall supply.

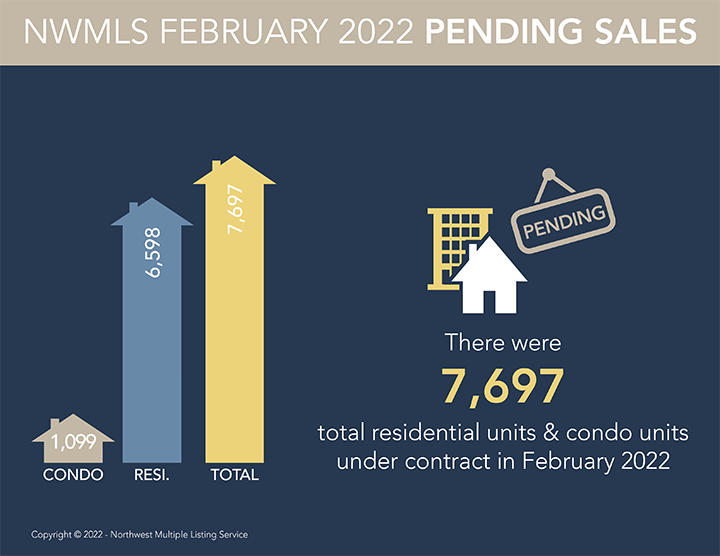

Sellers system-wide accepted 7,697 offers on their homes during February, about the same number (7,724) as a year ago, but a 21% jump from January’s volume of pending sales (6,350). Fourteen of the 26 counties in the MLS report had fewer pending sales than a year ago, a likely consequence of tight supply.

Closed sales also reflected 2022’s slower start compared to a year ago. Member-brokers logged 5,147 closed sales during February, a drop of 665 units (down 11.4%) from a year ago. This year’s volume of completed transactions through February is lagging year-ago totals by 12.6%.

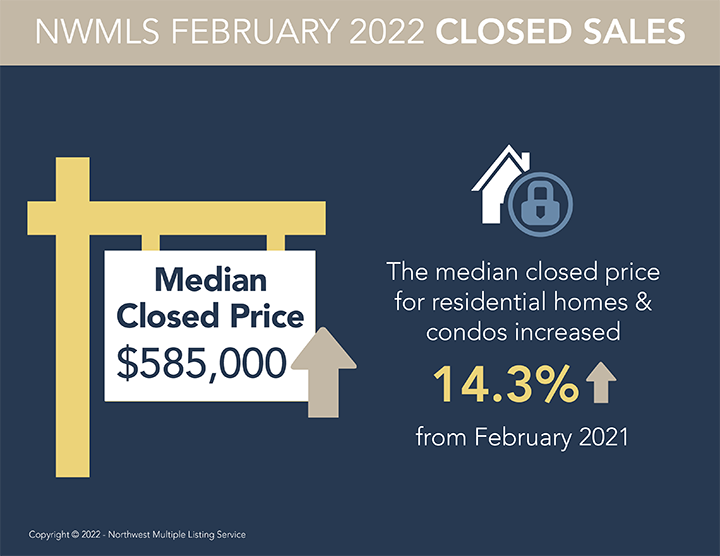

Prices continue to trend upward. The area-wide median price for last month’s closed sales of single-family homes and condominiums was $585,000, up 14.3% from a year ago, and up 5.4% from January.

Prices for single-family homes (excluding condos) rose at a smaller rate, about 12.2%, increasing from $535,000 a year ago to $600,000 last month.

Condo prices soared nearly 23% area-wide, with a YOY jump from $399,000 to $490,250.

Industry analysts believe conditions will probably continue to favor sellers.

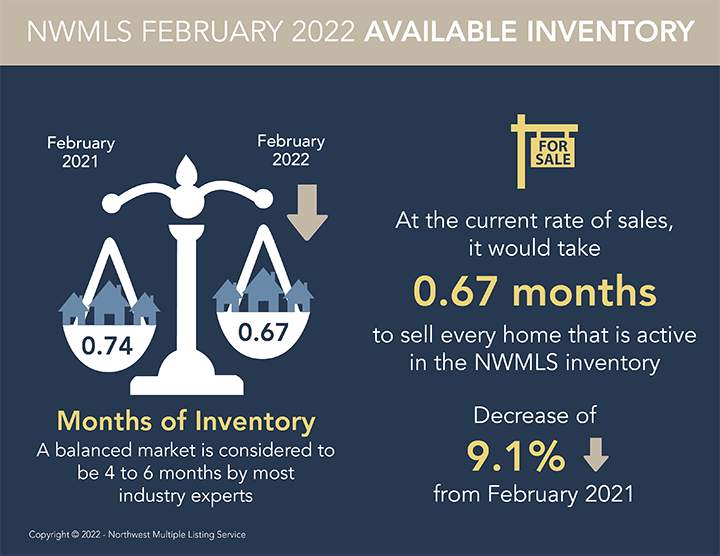

At the end of February, there were 3,461 total active listings in the MLS database, up from January’s total of 3,092 for a gain of nearly 12%, but down about 19.5% from twelve months ago when inventory included 4,298 listings of single-family homes and condominiums.

Measured by months of supply, there was about 19 days (0.67 months) at the end of February. That was the highest level since September 2021 when the MLS reported 0.75 months of supply.

A comparison of counties around Puget Sound shows positive growth in inventory and closed sales in Kitsap County. In King, Pierce, and Snohomish counties both listings and closed sales trended downward.

The housing market is not likely to correct anytime soon. With the new ‘working from home’ / hybrid work environments, continued region job growth and increased demand from investors and second homes buyers, the demand for housing in the Puget Sound region remains strong.

Interest rates are likely to continue going up, but uncertainty exists. According to Freddie Mac, the average rate on a 30-year, fixed-rate mortgage was 3.76% on March 3, down from two weeks prior when it was 3.92%, the highest rate since May 2019. A year ago, the average rate was 2.81%.

The Mortgage Bankers Association forecasts average rates will be slightly above 4 percent by the end of 2022. Mortgage data provider Black Knight estimates the average borrower with a 20% down payment would pay about $100 more a month on a new mortgage than one taken out at the end of last year due to rising rates and higher home prices.

Freddie Mac believes short-term mortgage rates will stay low but are likely to increase in the coming months. The mortgage finance giant said geopolitical tensions caused U.S. Treasury yields to recede last week as investors “moved to the safety of bonds.” Along with inflationary pressures, Freddie Mac points to “the cascading impacts of the war in Ukraine” for creating market uncertainty.

Whether buying, selling, or investing, be sure to leverage the experience and expertise of our trusted real estate team, The Goelzer Home Team. Let us know how we can help you achieve your real estate Wants, Needs, and Dreams!

Data

*Information and statistics compiled and reported by the Northwest Multiple Listing Service.