Summary

- The overall real estate market in the Puget Sound region remains very bullish – multiple offers and increasing sales prices are common.

- Double-digit price increases YOY is common across the region. Prices rose in every county served by the NWMLS, with seven counties reporting YOY price hikes of 25% or more.

- Despite more homes coming on the market, demand continues to outstrip supply, keeping inventory depleted. Area-wide, NWMLS figures show there are only about two weeks of inventory (0.53 months of supply) of single-family homes and condominiums

- While interest rates have been fluctuating, buyers continue to take advantage of historically low rates.

- Buyers who are pre-approved (or underwritten), conduct pre-inspections, and bring strong offers (not always the highest purchase price) that are non-contingent are winning.

- Sellers should continue to prepare your home by making it look its best to attract top dollar for their sale.

- Sellers, be cautious of off-market sales (e.g., selling to your neighbor, friend, or someone offering cash for a quick sale), as you will most likely lose significant equity you’ve earned. Hire a professional Realtor who will prepare and market/expose your home to the open market and negotiate on your behalf. The commission you will pay to hire a professional will be minimal compared to the potential lost equity homeowners are giving away.

Details

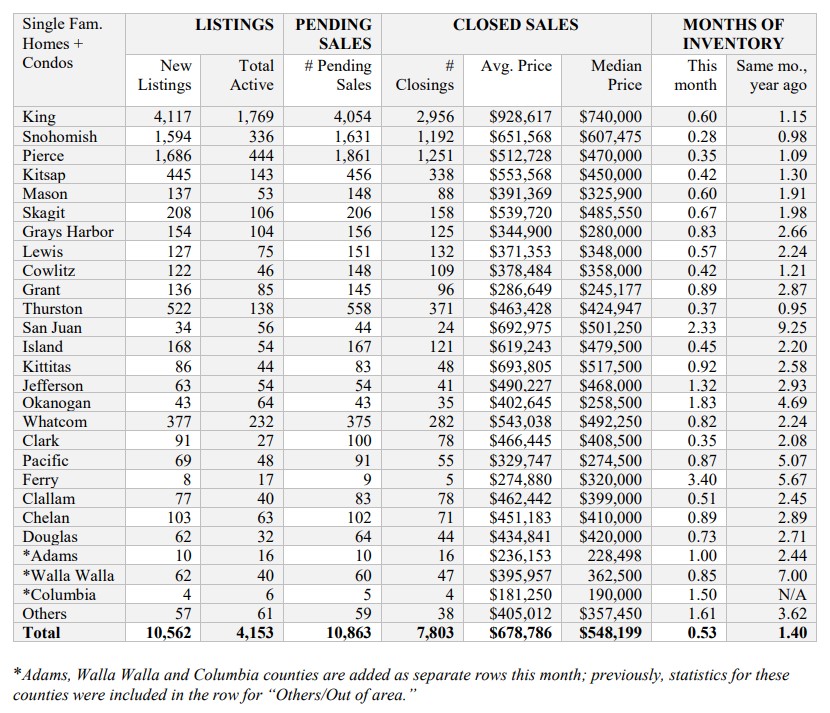

Brokers with Northwest Multiple Listing Service (NWMLS) added 10,562 new listings to inventory during March — the highest volume since September when they added 11,210 properties to the selection. Even so, demand continued to outstrip supply, keeping inventory depleted.

The latest statistical summary from Northwest MLS shows double-digit price hikes were widespread across the 26 counties included in the report for the month of March.

Brokers logged 10,863 pending sales last month. That volume of mutually accepted offers marked a 22.3% increase from a year ago and a 40.6% surge compared to February.

James Young, director of the Washington Center for Real Estate Research at the University of Washington, agreed, noting March marked the first post-COVID/pre-COVID comparison. “It is very difficult to compare year-on-year results once lockdown started in late March 2020,” he stated. “The drop in the number of active listings between now and last year is extraordinary,” Young exclaimed.

NWMLS statistics show a 55.9% decline in total active listings, shrinking from 9,418 at the end of March 2020 to 4,153 at month end. Young noted the decrease is even more pronounced in “peripheral counties.” Six counties (Clallam, Clark, Island, Kittitas, Mason, and San Juan) experienced year-over-year declines of 69% or higher, according to the latest report from Northwest MLS. “This collapsing active listing volume in the face of high demand is telling. As this was occurring, the number of pending transactions year-over-year increased markedly. Double digit price increases throughout the region are the natural result,” said Young.

Median prices system-wide surged 19.5% compared to a year ago. The median price for the 7,803 sales that closed during March was $548,199; a year ago it was $458,900. Prices rose in every county served by NWMLS, with seven counties reporting YOY price hikes of 25% or more.

Last month’s median price on closed sales of single-family homes and condos (combined) was up 7% from February’s figure of $512,000.

Excluding condos, the median price on single family homes rose nearly 21% from a year ago, from $470,000 to $567,250. Compared to the previous month (February), prices were up 10% OR more in seven counties (Cowlitz, Douglas, Jefferson, Ferry, Island, King, and Pacific).

From January through March this year, brokers reported 400 sales priced at $2 million or more. That’s more than twice the highest number reported for the first quarter of any of the previous five years. (Last year, brokers reported 178 sales at $2 million-plus during the first quarter.)

Condominium prices rose 5.2% year-over-year on closed sales that increased 16% (from 1,015 closings a year ago to last month’s total of 1,179). The volume of new listings (1,528) was similar to the year-ago total (1,455), while the number of active listings (total inventory) dropped 23% YOY. Pending sales of condos surged nearly 43% from a year ago (from 1,101 to 1,574).

Area-wide, NWMLS figures show there is only about two weeks of inventory (0.53 months of supply) of single-family homes and condominiums. Only six counties have more than one month of supply. The supply of single-family homes is even more depleted (0.47 months), Condo buyers fare slightly better with 0.86 months of supply. With demand outstripping supply, prices tend to rise.

NWMLS director, Meredith Hansen, owner/designated broker at Keller Williams Greater Seattle, noted the Seattle area ranked second nationally in home price appreciation for the past 12 months. (Phoenix led all cities in the latest S&P CoreLogic Case-Shiller Indices.) “If no new inventory came on the market, we are at 2.19 weeks of inventory, leading to bidding wars, escalating prices, and severe buyer fatigue,” Hansen remarked.

Escalating prices are found throughout the Northwest MLS service area. “Most of the rapid price increases follow the familiar trend of late where the I-5 and I-90 corridors outside of King County are showing exceptional levels of house price growth,” observed Young. “Median house price growth in Skagit County (27.3%), Kittitas County (43.8%), Thurston County (21.2%) and Whatcom County (20.8%) all outperformed King County at 14.7%,” he noted. Kitsap, Snohomish, and Pierce counties also outgained King County’s price growth.

Inventory in Kitsap county is down more than 64% from a year ago, and like many counties, pending sales are outgaining new listings.

Both local and national industry-watchers detect rising optimism for the spring housing market. A recent national jobs report showed broad-based employment gains, including significant growth in areas hit worst by the pandemic, such as the leisure and hospitality sector.

National experts believe housing activity could slow due to increasing mortgage rates and inflation… along with lumber costs. A recent report by Bloomberg noted the 30-year fixed-rate mortgage rose to 3.17%, the highest level in more than nine months, after falling to an all-time low of 2.65% in January. Although possible, we’re not seeing a slowdown in housing sales in our region.

In a housing market like the one we are experiencing now, be sure to leverage the expertise of a trusted real estate team. Let us know how we can help you achieve Your real estate Wants, Needs, and Dreams.